Simplify Global Shipping with Accurate HS Codes

Ensure Compliance and Smooth Customs Clearance—Every Time

Understanding HS Codes

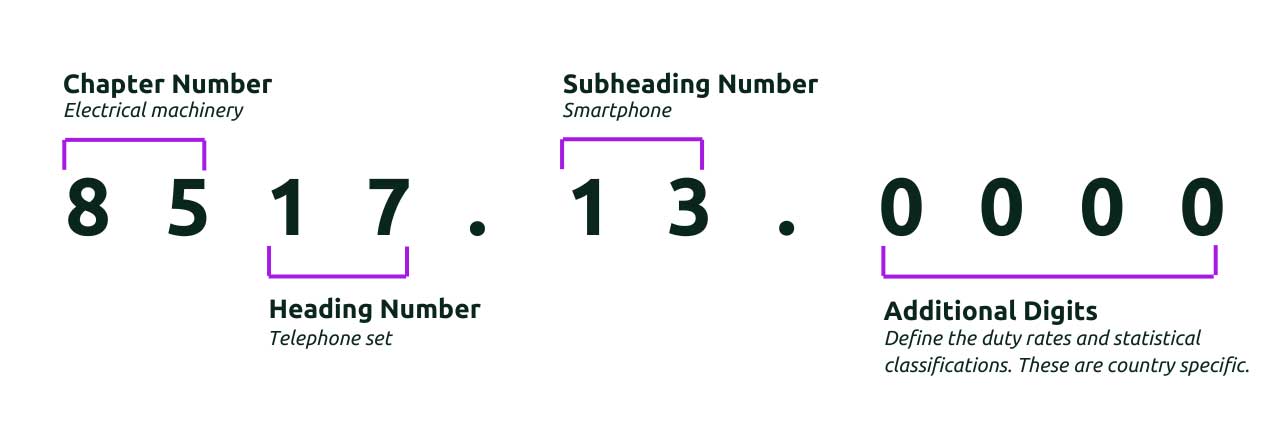

When it comes to international shipping, one of the most critical factors for smooth, compliant transit is the Harmonized System (HS) code. HS codes are standardized numerical classifications for traded products, used by customs authorities worldwide to determine applicable duties and taxes, as well as for statistical tracking.

How Buku Ship Helps You with HS Codes

-

Automated Assignment

We automatically assign HS codes to your products—saving you time and reducing the risk of errors. -

Global Compliance

Whether you’re shipping to the EU, UK, Canada, Australia, or beyond, we ensure your products are classified accurately for every destination. -

Seamless Integration

Our platform integrates directly with your Shopify store or other e-commerce solutions, making it easy to assign the correct HS codes to each shipment. -

Faster Customs Clearance

Accurate HS codes help speed up customs clearance, reducing delays and ensuring your products reach customers more efficiently.

What are HS Codes?

HS codes are a standardized numerical system used globally to classify traded products. They help customs authorities identify the goods in your shipment, ensure accurate duty and tax calculation, and verify compliance with international regulations.

Without the correct HS code, your shipments may face delays, fines, or even rejection at customs.

Why Accurate HS Codes Matter

Using the correct HS codes is essential for avoiding costly mistakes. Incorrect codes can result in customs delays, penalties, and frustrated customers waiting on their orders. Buku Ship removes the guesswork by assigning accurate HS codes to your products—ensuring smooth customs clearance and faster, hassle-free deliveries.

Clear Customs Every Time

No Delays. No Hassles. Just Quick, Easy Global Shipping—Delivered Direct to Customer.

Accurate HS code classification is essential for smooth international shipping. This often involves working with customs experts or using specialized services to ensure precision. Investing in proper classification upfront saves time and money—by reducing delays, avoiding fines, and ensuring customs compliance.

For international shippers, correctly applying HS codes isn’t just a regulatory checkbox—it’s a strategic business practice that directly impacts operational efficiency and your bottom line.